Lump sum payment tax calculator

Combine all lump-sum payments that you have paid or expect to pay in the calendar year when determining the composite rate to use. Calculate 115 of the average.

How Much Term Life Insurance Cover Do I Need Online Insurance Coverage Calculator Term Life Life Insurance Policy Life Insurance Calculator

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

. The tax free amount of Eileens retirement lump sum is calculated by adding the basic exemption plus the difference between the SCSB and the basic exemption. How you calculate PAYE depends on your employees tax code. Add the lump sum payment to the grossed-up annual value of the employees income including their secondary tax codes low threshold amount if appropriate.

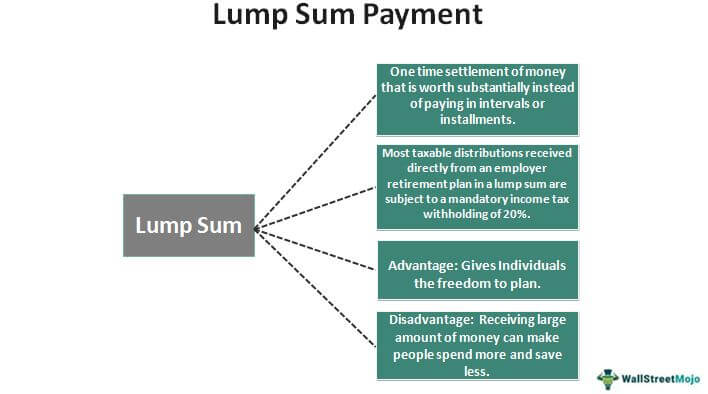

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. To claim this you must not have received a lump sum payment in the past ten years. A lump-sum distribution is the distribution or payment within a single tax year of a plan participants entire balance from all of the employers qualified plans of one kind for example.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Use the following lump-sum withholding rates to. Calculate average annual pay for last three years.

Ad Use our tax forgiveness calculator to estimate potential relief available. Get your free guide today. You will also need the amount of past-due support the.

Download our free guide Is a Lump Sum Pension Withdrawal Right for You. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Discover Helpful Information And Resources On Taxes From AARP.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. You may be due to receive a lump. If Lump Sum Payments Bonus Etc.

If your state does. Annuity payment calculator compares two payment options. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

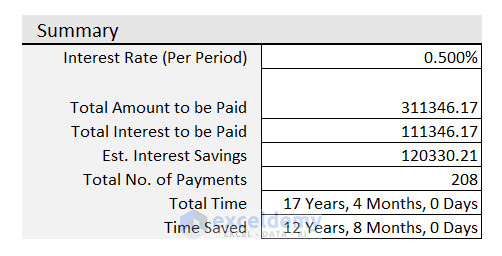

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. It will take between 1 and 2 minutes to use. Lump Sum Extra Payment Calculator.

This could be a. How to Calculate Taxes on a Lump Sum Sapling. Find a Branch Contact a Financial Advisor Finras Brokercheck CALL 1-877-579-5353.

Calculate how much tax youll pay when you withdraw a lump sum from your pension in the 2020-21 2021-22 and 2022-23 tax years. This document is a withholding schedule. The federal tax withholdings are taken out before receiving.

Our lump sum vs. Receiving a lump sum. We have the SARS tax rates tables.

You may claim an increased exemption up to 10000. When youre 55 or older you can. Ad Our Resources Can Help You Decide Between Taxable Vs.

Ad Learn the alternatives to your pension plan. You will also pay state taxes that can. Table 02 - PAYE Tax deduction for Lump-sum-payments.

A lump-sum distribution here is the distribution or payment within one tax year of a participants plans entire balance from all of the employers qualified plans of one kind. You must deduct PAYE on lump sum payments. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

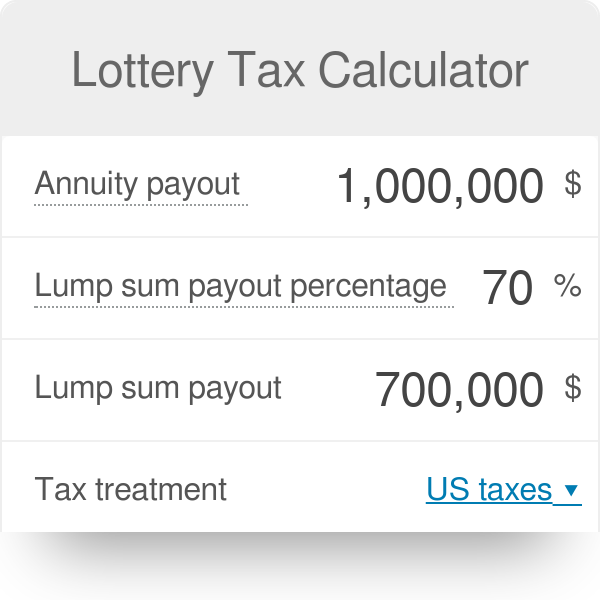

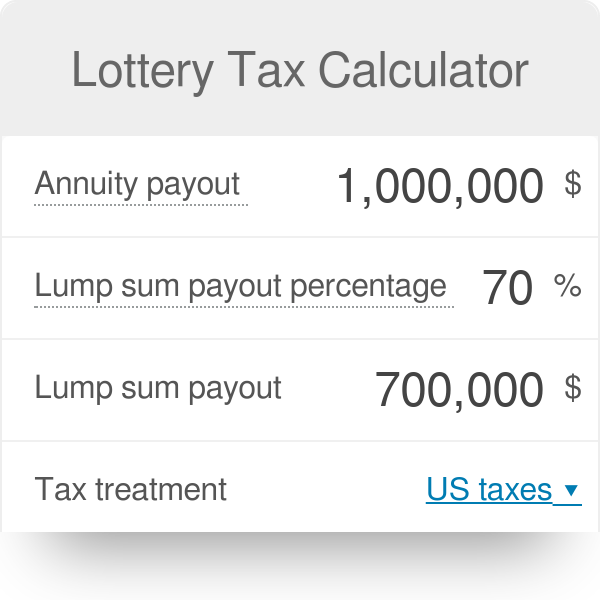

To use the Lump Sum Calculator you will need your copy or copies of the Income Withholding for Support PDF for the employee. The ATO app includes a simplified version of the Tax withheld calculator for use by employers and workers. Lottery Payout Calculator provides Lump-Sum and Annuity Payout for Megamillions Powerball Lotto.

ATO app Tax withheld calculator. Lump Sum Payments Bonus Etc Average Monthly Profits Income From employment. Student loan repayments and KiwiSaver If your employee uses an M SL or.

Whether its from a tax refund inheritance bonus or something else making a one-time lump sum extra payment towards your debt can help you. Calculation of tax relief on Eileens retirement lump sum Calculation Value. For payments made on or after 13 October 2020.

This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Schedule 7 Tax table for unused leave payments on termination of employment. Federal Bonus Tax Percent Calculator.

Calculate the PAYE rate. At least 240000 will automatically be withheld by the federal government and the rest up to 130000 you will owe at tax time the next year.

Lump Sum Payment Meaning Examples Calculation Taxes

Pin On Mortgage Calculator Tools

Infographic How Can You Use Home Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Lottery Tax Calculator

Taxes On Lottery Winnings Calculator Store 56 Off Www Ingeniovirtual Com

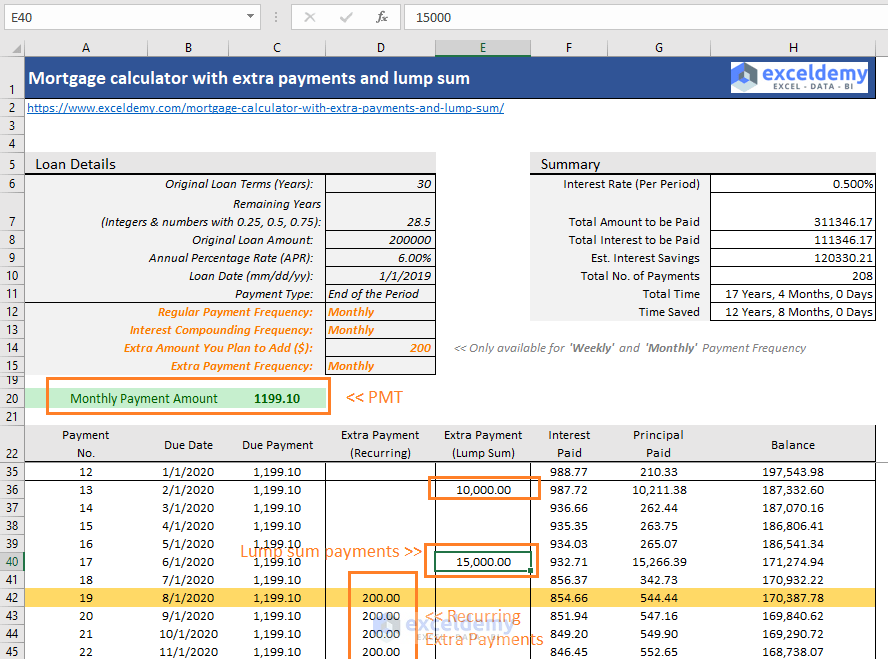

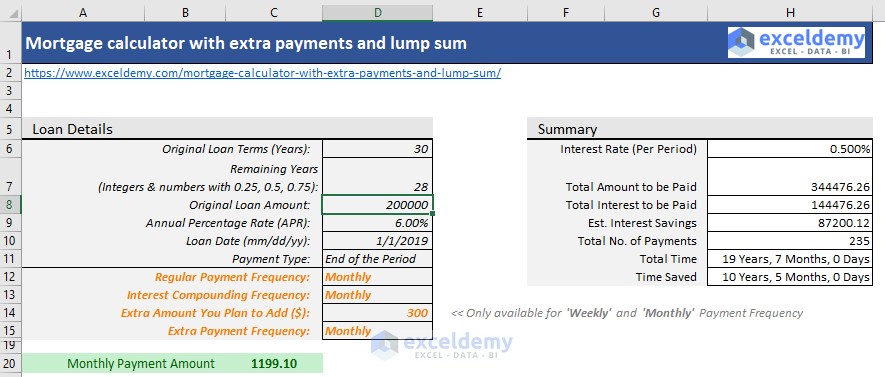

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

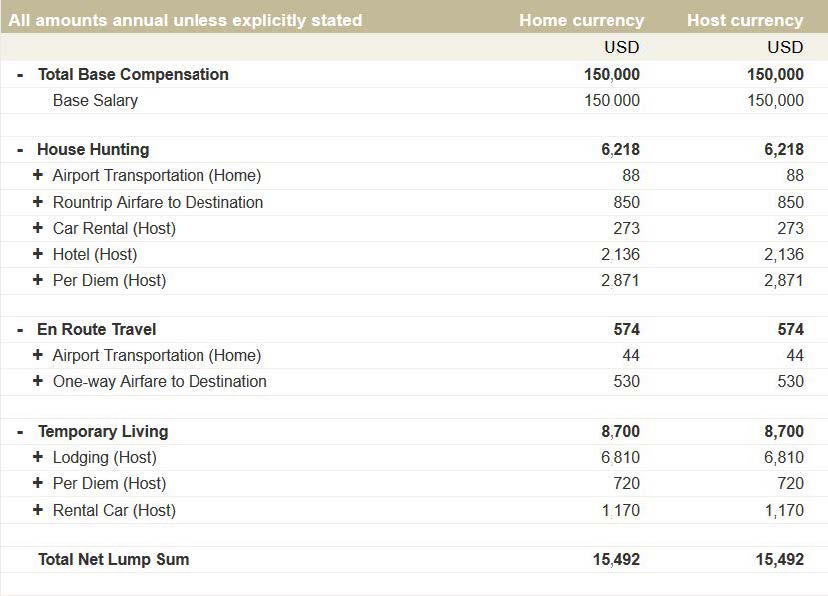

Lump Sum Calculator Airinc Workforce Globalization

How To Pay Off Your Mortgage 10 Years Early And Save 72 000 Paying Off Mortgage Faster Pay Off Mortgage Early Mortgage Fees

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

The Mortgage Payment Calculator Helps You Determine How Much Interest You Save Or How Much Of A Mortgage Mortgage Payment Mortgage Payment Calculator Mortgage

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Lump Sum Payments To Departing Employees

Lumpsum Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Lump Sum Calculator Airinc Workforce Globalization

Elss Calculator For Monthly Sip And Lumpsum Sip Calculate Returns In 3 Quick Step How To Find Out Months Taxact

Mortgage Calculator With Extra Payments And Lump Sum Excel Template